Zwitch: India's Best Online Payment API Solution

Your all-in-one platform to accept online payments, process payouts, and seamlessly onboard clients, helping you enhance your existing products and boost your revenue.

Powering

4 Million+

Businesses

Supporting

150+

Payment Methods

Processing

$35 Billion+

in transactions

One Integrated Financial Stack For Your Business

Streamline Costs, Boost Revenue, and Enhance Efficiency with Our All-in-One Platform

Leverage Zwitch APIs to manage all your payment needs, revenue operations, and explore new business models effortlessly.

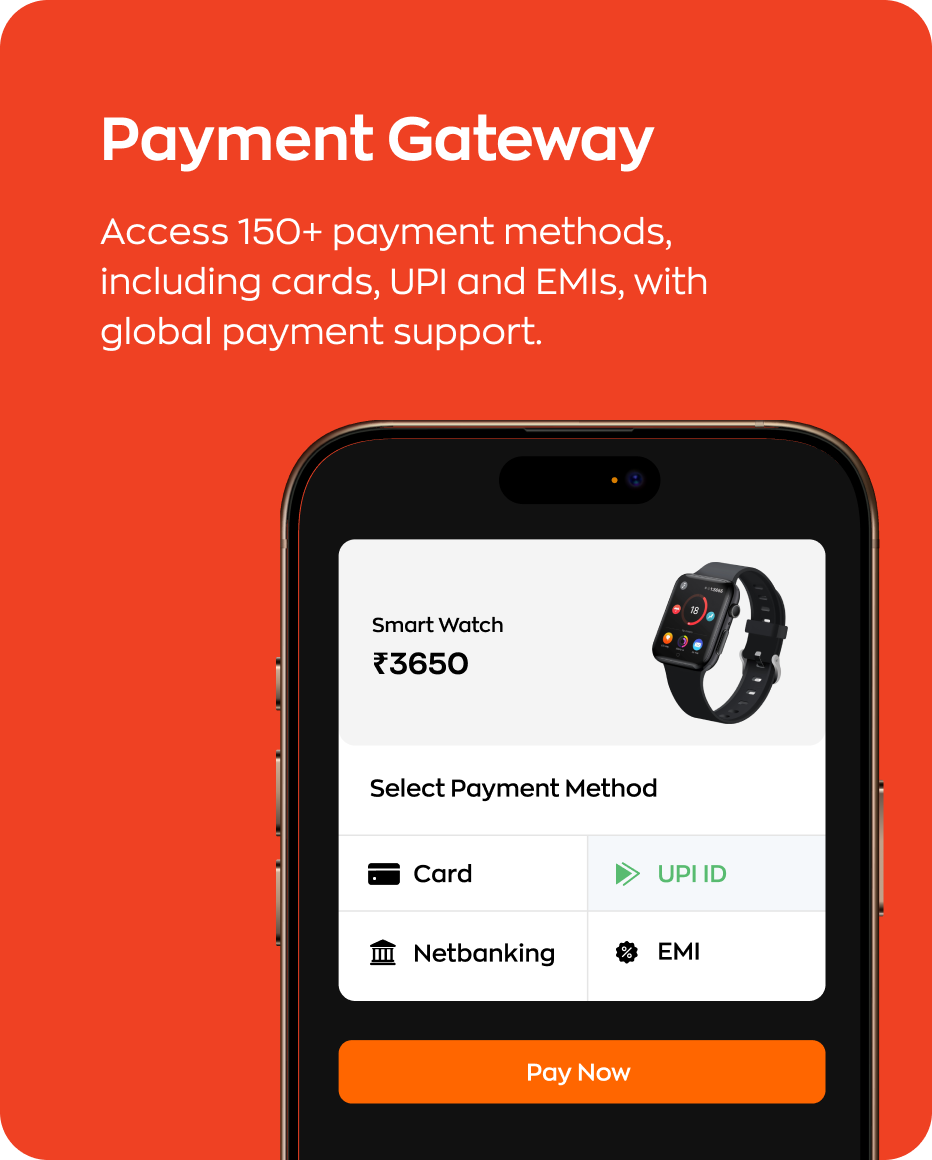

Payment Gateway

- 150+ Payment Options

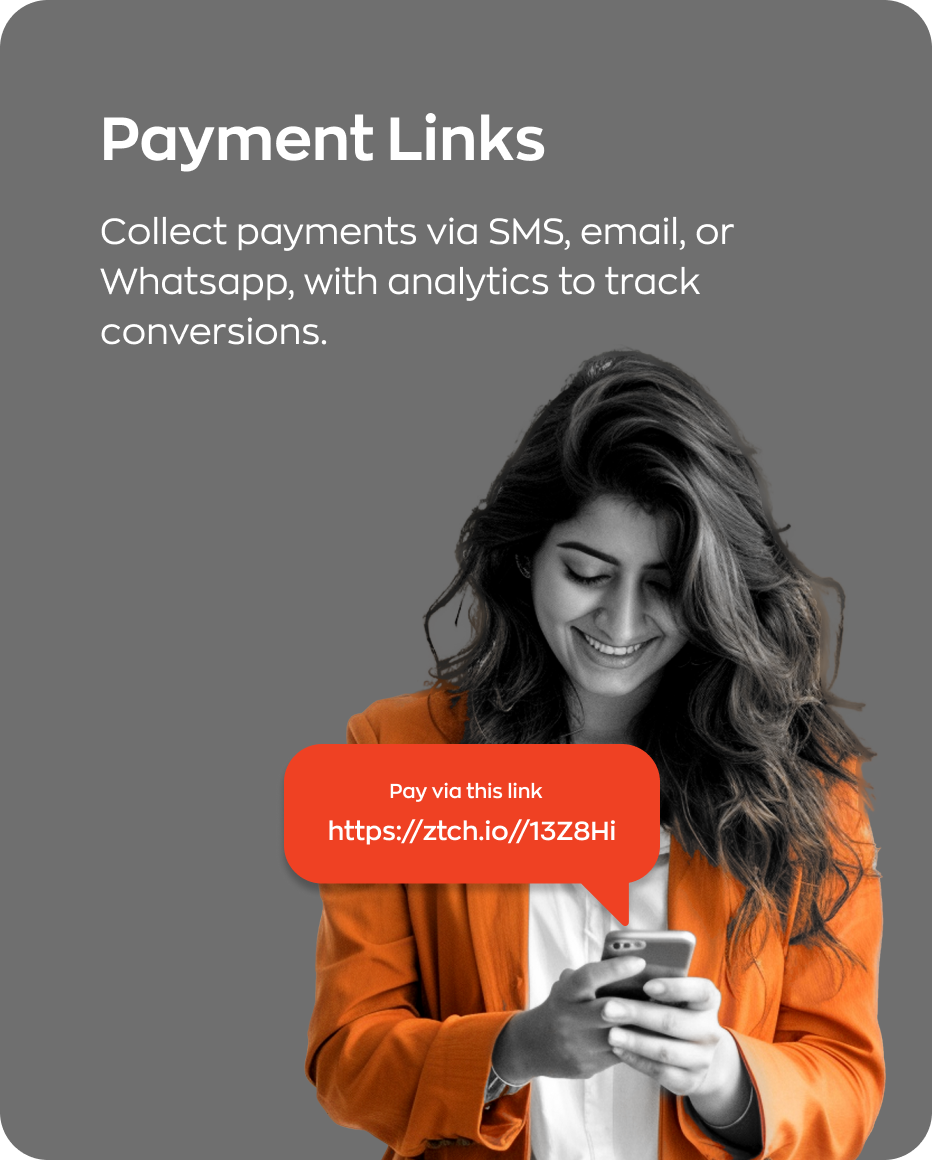

- Payment Links

- Instant Refunds

- Recurring Payments

- Native SDKs & Plugins

Payouts

- Connected Banking with 150+ Banks

- Payouts API

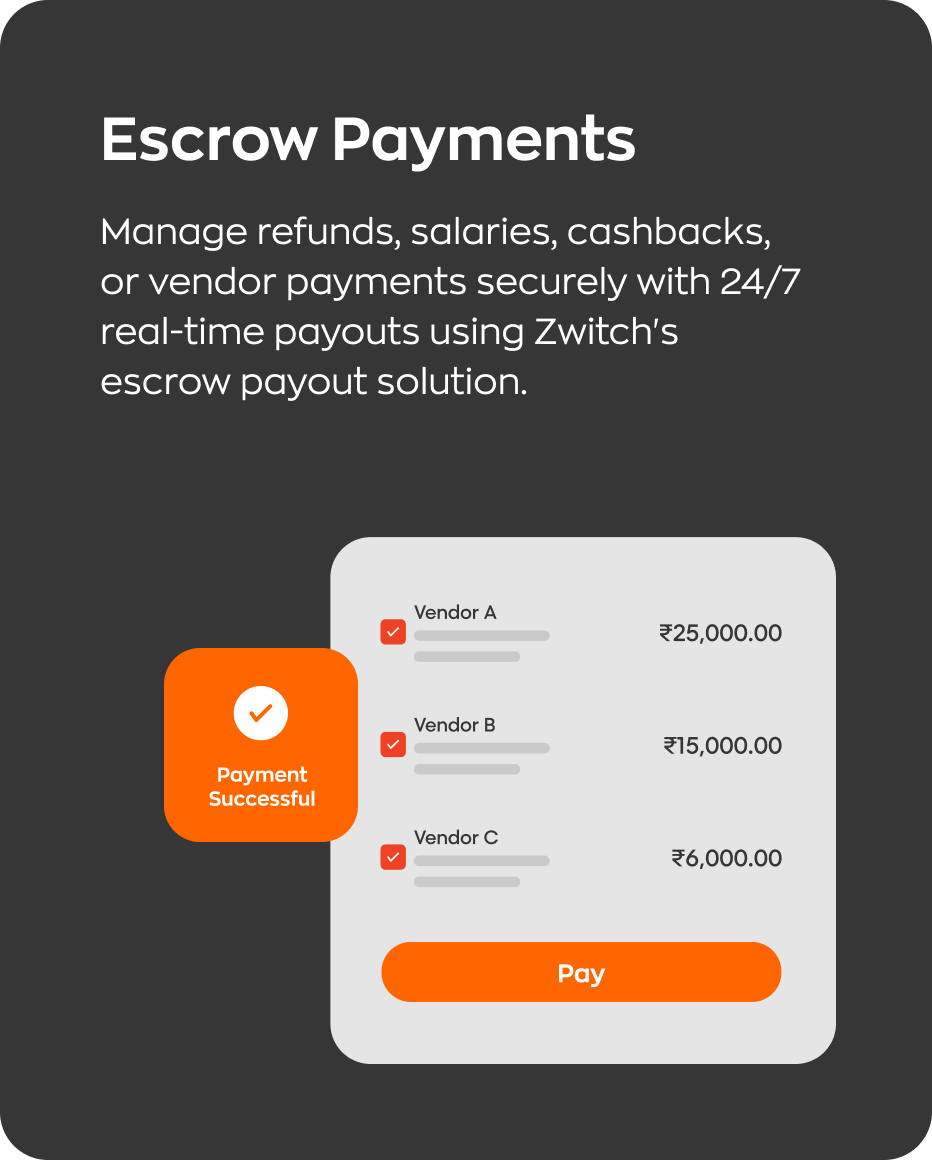

- Escrow Payments

- NEFT / RTGS/ IMPS / UPI

Zwitch Bill Connect

- Connected with 1000+ ERPs and Banks

- 150+ Connected Payment Methods

- Instant Bill Discounting

API Marketplace

- Verification APIs

- Compliance APIs

- Onboarding APIs

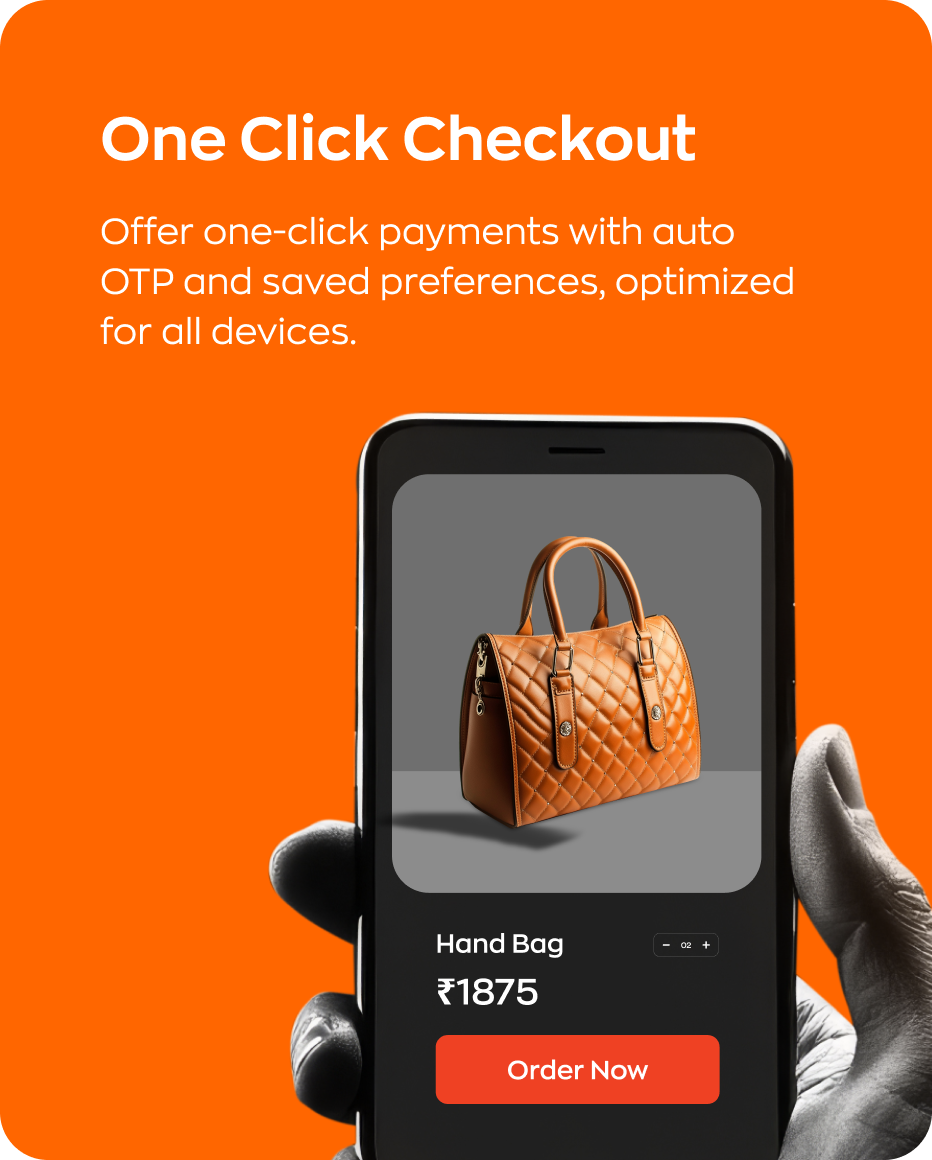

Accept Payments Online with Ease

Streamlined Checkout, Higher Success Rates, and Diverse Payment Options

Experience the future of online payments with Zwitch. Our platform ensures faster checkouts, maximizing conversion rates while offering a wide range of payment options to cater to every customer. Simplify the payment process and watch your revenue grow with our digital payment solutions.

Instant Account-to-Account Transfers Supported by 150+ Banks

Effortless Payouts with Connected Banking

With Zwitch, enjoy the ease of direct account-to-account payouts across 150+ banks. Our connected banking solution offers instant, secure transactions, ensuring your business stays agile and your payouts are always on time. Simplify operations and focus on growth, knowing your payments are handled seamlessly.

Zwitch Bill Connect

Embed Interoperable Bill Payments by Connecting with 1000+ ERPs, Billers and Banks Using NPCI's Bharat Connect Network

Connect your ERP to thousands of other ERPs and banking platforms like Zoho, Happay, HDFC Bank, and ICICI Bank via Zwitch Bill Connect powered by NPCI's Bharat Connect. Enable your customers to pay and receive invoices and make real-time B2B payments by connecting their current accounts from 150+ banks, all within your software.

Connect to ERPs

Enable invoicing between your ERP and thousands of other platforms like Zoho and ICICI on the NPCI Bharat Connect Network.

Embed B2B Payments

Enable bill payments by connecting 150+ bank accounts directly from your app.

Real-Time Tracking

Monitor invoice statuses and payments in real-time for accurate reconciliation.

Generate Additional Revenue

Generate new revenue by facilitating interoperable bill payments and reconciliation within your existing app.

Zwitch Verification API Suite

Enhance Compliance and Verification with Powerful APIs

Discover a versatile collection of APIs designed to enhance every aspect of your business—from verification and compliance to onboarding and UPI-based solutions. Zwitch empowers developers with the tools they need to build secure, scalable, and compliant applications.